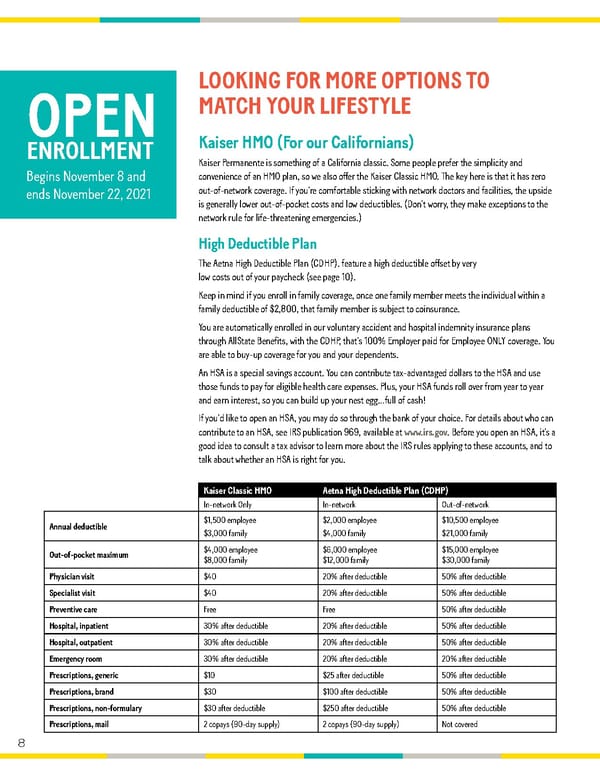

LOOKING FOR MORE OPTIONS TO OPEN MATCH YOUR LIFESTYLE ENROLLMENT Kaiser HMO (For our Californians) Kaiser Permanente is something of a California classic. Some people prefer the simplicity and Begins November 8 and convenience of an HMO plan, so we also offer the Kaiser Classic HMO. The key here is that it has zero ends November 22, 2021 out-of-network coverage. If you’re comfortable sticking with network doctors and facilities, the upside is generally lower out-of-pocket costs and low deductibles. (Don’t worry, they make exceptions to the network rule for life-threatening emergencies.) High Deductible Plan The Aetna High Deductible Plan (CDHP). feature a high deductible offset by very low costs out of your paycheck (see page 10). Keep in mind if you enroll in family coverage, once one family member meets the individual within a family deductible of $2,800, that family member is subject to coinsurance. You are automatically enrolled in our voluntary accident and hospital indemnity insurance plans through AllState Benefits, with the CDHP, that’s 100% Employer paid for Employee ONLY coverage. You are able to buy-up coverage for you and your dependents. An HSA is a special savings account. You can contribute tax-advantaged dollars to the HSA and use those funds to pay for eligible health care expenses. Plus, your HSA funds roll over from year to year and earn interest, so you can build up your nest egg…full of cash! If you’d like to open an HSA, you may do so through the bank of your choice. For details about who can contribute to an HSA, see IRS publication 969, available at www.irs.gov. Before you open an HSA, it’s a good idea to consult a tax advisor to learn more about the IRS rules applying to these accounts, and to talk about whether an HSA is right for you. Kaiser Classic HMO Aetna High Deductible Plan (CDHP) In-network Only In-network Out-of-network Annual deductible $1,500 employee $2,000 employee $10,500 employee $3,000 family $4,000 family $21,000 family Out-of-pocket maximum $4,000 employee $6,000 employee $15,000 employee $8,000 family $12,000 family $30,000 family Physician visit $40 20% after deductible 50% after deductible Specialist visit $40 20% after deductible 50% after deductible Preventive care Free Free 50% after deductible Hospital, inpatient 30% after deductible 20% after deductible 50% after deductible Hospital, outpatient 30% after deductible 20% after deductible 50% after deductible Emergency room 30% after deductible 20% after deductible 20% after deductible Prescriptions, generic $10 $25 after deductible 50% after deductible Prescriptions, brand $30 $100 after deductible 50% after deductible Prescriptions, non-formulary $30 after deductible $250 after deductible 50% after deductible Prescriptions, mail 2 copays (90-day supply) 2 copays (90-day supply) Not covered 8 8

California Pizza Kitchen Flipbook Page 7 Page 9

California Pizza Kitchen Flipbook Page 7 Page 9