California Pizza Kitchen Flipbook

Benefits Guide | 20 pages

2022 Benefits Guide #LiveWellBeingYou For Salaried & RSC Employees

BENEFITS TO LIVE WELL BEING YOU! Choose the benefits that work for you! OPEN ENROLLMENT Begins November 8 and ends November 22, 2021 CONTENTS Overview ............................................................................3 You and Yours .....................................................................4 Embrace Change .................................................................5 EPO and PPO Options: .........................................................7 Looking For More Options to Match Your Lifestyle ...................8 Check, Please — ..................................................................10 Smile! You’re Saving On Dental Coverage ...............................11 See the Benefits: Your Vision Plan .........................................11 Ahh, Hawaii ........................................................................12 When to Call? .....................................................................14 Peace of Mind, Pennies for a Day ...........................................15 NEW! Voluntary Plans ..........................................................16 Your Future Is Calling ...........................................................17 Lower Your Taxes, Boost Your Security ...................................17 No Matter Where You Go, There We Are ..................................18 Important Contacts ............................................................19 2

OVERVIEW Affordable Care Act aka Healthcare Reform We create phenomenal experiences for our guests by bringing the biggest and best parts of ourselves to work. We are committed to help you in your journey to stay strong and inspired and to live well All of CPK’s medical plans meet the being you. So what does living well mean? Well, that’s the thing – it’s totally up to you! What keeps Affordable Care Act (like the minimum you inspired, healthy and whole? What gets you in the California state of mind? Sometimes, it’s value and minimum essential coverage). finding inspiration that fuels your passion. And sometimes, it’s paying close attention to your medical, financial and emotional wellness that ensures you meet your needs for the year ahead. Our plans offer service options and that will make sure you’re at your best in all areas of your Preventive Care life, including: l Preventive care at no cost to you – It’s important to keep up with your health now so you hit fewer l Routine wellness checks bumps down the road. Why not see your doctor when you feel well, get your immunizations and l Screenings, such as body mass screenings, and catch potential problems early? Preventive care is offered through our Aetna and index (BMI), vaccinations, and Kaiser providers and includes: high blood pressure screenings Ÿ Routine wellness checks l Weight management Ÿ Screenings, such as body mass index (BMI), vaccinations, and high blood pressure screenings See pages 8-9 for details about preventive care benefits available through Aetna and Kaiser. See pages 8-9 for details about preventive care benefits available through Aetna and Kaiser. l A choice of many types of health plan options – No two CPK employees are the same, so choose the coverage that’s right for you: Open Enrollment for Ÿ Aetna PPO – choose any doctors in or out of the network – just know the plan always covers more of Your 2022 Benefits your cost if you stay in-network. Ÿ Aetna EPO – similar to a PPO plan however you need to stay in the network for coverage. After reading through all of that, we Ÿ Aetna CDHP – this consumer driven health plan has the lowest premiums of all of our plans and hope you’re excited about choosing your gives you the opportunity to contribute to a health savings account (HSA). benefits! Open Enrollment starts on Ÿ Kaiser HMO – an HMO plan that’s only available in California November 8 and ends November 22, 2021. Ÿ HMSA PPO & HMSA HMO & Kaiser – for employees who live in Hawaii Make sure to get answers to any questions you have and get ready to enroll for the All Aetna plans include Teladoc and Kaiser includes Telehealth. These programs gives you access to benefits that are just right for you. networks of board-certified physicians, either by phone or online. Learn more on page 14. See pages 8-10 to learn more about what’s available to you. l Plans that help you take care of your financial health – This is an important part of your well-being. Want to save for your future? These plans add a lot of value and make it convenient to save for what’s ahead: Ÿ The 401(k) Plan lets you save pre-tax from your paycheck and choose from a variety of investment funds. See page 17 for more info. Ÿ Health Savings Accounts (HSAs) lets you save pre-tax for your health care expenses – for now or for later. You can only use this account with a with a High Deductible Plan (CDHP). See page 8 for details. l A Program that helps you through any life challenge including: mental and emotional health, financial issues, relationships, legal matters and more – Don’t overlook this important component of your total well-being. Ÿ Employee Assistance Program (EAP) helps you deal with all kinds of life issues. Because sometimes life gets bumpy. There are lots of tools and resources to use – even a phone line that’s available 24/7. See page 6. 3

YOU AND YOURS Who’s a Domestic Partner? According to our attorneys, “anyone Love Your Benefits. Share Your Benefits. over the age of 18 of the same or We’re sure you’ll love your CPK benefits, and we wish you could share them with everyone, but rules opposite sex, engaged in a spouse-like are rules and there are some limits on who’s eligible. relationship that is characterized by mutual caring and dependency.” Who You’re All In says lawyers can’t be sentimental? You’re eligible for benefits as a salaried or RSC full-time employee after one month of employment, effective on the first day following that month. Domestic Partners Share the Love: Covering Dependents and Your Taxes What could make your CPK benefits even better? Sharing them with your loved ones. You’re welcome to enroll dependents including: While we recognize domestic partners l Your legally married spouse or domestic partner and their dependents as part of your l Your kids: biological, adopted, stepchildren, dependents of your domestic family, the IRS may not. In that case, the partner — up to age 26, we’ll take them all value of their coverage may be treated as income for the purpose of your tax l Disabled dependents over the age of 26 withholding and employment taxes. Keep in mind that you’ll need to show proof of dependent status the first time you enroll each dependent; if you don’t, you risk termination of your dependent’s coverage. Coverage Levels To help you pick the right coverage, you can choose from four levels: l Yourself only l You plus your spouse or partner l You plus any number of children l Your whole family or partner plus family Everybody needs to enroll in the same plan. For example, you can’t have your kids in the Kaiser HMO while you’re in the PPO Choice. Consider it one less thing you have to keep track of. 4

EMBRACE CHANGE Have Questions? Just Call. Mid-Year Adjustments This stuff can get complicated fast, Once you make your enrollment decisions you can’t change your mind until next year’s Open but we’ve got your back. Call the CPK Enrollment. Sorry, we know it’s disappointing, but the IRS won’t let you. Enrollment Center at 877-CPK-BENE (877-275-2363) and we’ll be happy to There’s an exception, though. If you experience a big change in your life, also known as a “qualifying sort it all out. life event” (the IRS again, don’t ask), you are allowed to make changes. These big life events include: l Marriage, divorce, or domestic partnership changes l Birth or adoption of a child l Change in eligibility, for either you or a dependent Skip to the Ending? l Death of a covered dependent We’re really proud of this If you think any of these apply to you, be sure to call 877-CPK-BENE. Please note, as of March 1, 2020 and we hoped you’d read it all. But if deadlines for notifying CPK of a HIPAA special enrollment event (i.e., birth, adoption, marriage, loss of you’re absolutely, positively sure you’re other coverage and Medicaid/CHIP events) has been extended. Due to the national emergency relating ready to enroll now, see page 18. to COVID-19, federal regulators have issued guidance that requires the Plan to disregard the “outbreak period” (as defined below) when determining the deadline to provide notification of HIPAA special enrollment events and other plan related deadlines. The “outbreak period” is defined as the period that began from March 1, 2020, through 60 days after the announced end of the COVID-19 “National Emergency”. You can disregard, or toll, this “outbreak period” for purposes of calculating the normal 30-day notification period (or 60 days if losing Medicaid/CHIP coverage) for HIPAA special enrollment events. If you have more questions about the notification extensions, please contact the CPK benefits department. Maintaining Coverage Coverage begins on January 1, 2022 and runs through December 31, 2022 except: l If your employment ends, your medical and dental coverage will too at the end of the month in which you terminate. l If at any time the full deduction can’t be taken from your paycheck, it then becomes your responsibility to submit payment to CPK in order for your insurance coverage to stay in effect. If payment is not received, coverage will be terminated upon notice. For questions regarding your balance or payment, please contact the People Care team at 310-342-4672. 5

WELLNESS Our benefit carriers offer an amazing range of programs, tools, resources and information. Make sure you visit your carrier’s website to learn about all the programs and services your plan provides! Aetna Programs Preventive Care Is Free! l Call a doctor! Talk to a board-certified physician about non-emergency Regular checkups and screenings are an medical issues anytime, anywhere through the Teladoc program. important part of staying well, and most l Maternity Program. Provides expectant moms the support and care they need recommended services are covered at during their pregnancies. no charge by our medical plans. ® l Simple Steps To A Healthier Life Program. Take advantage of these online programs to help you reach your health goals. ® l Talk to a nurse. Call the Informed Health Line whenever you have a health question. Advice nurses can discuss a wide variety of health and wellness topics to help you stay healthy and get better care. Call 800-556-1555 anytime. l Aetna Health Connections. No one can be perfectly healthy. But even if you have a significant, OPEN ongoing health condition, you can reach your own level of good health with the advice and support you need. ENROLLMENT l Natural products and services. There are many paths to healthy living. Save on therapies like Begins November 8 and massage, acupuncture, and chiropractic care, over-the-counter vitamins and other ways to ends November 22, 2021 complement your health. It’s a smart way to save on things insurance doesn’t normally cover. l Weight management. Lose weight and feel great with discounts on some of today’s most popular weight loss programs, including eDiets, Jenny Craig, and Nutrisystem. Kaiser Programs l Know where you stand. Start with a Total Health Assessment, then set goals and get going with a customized action plan for better health. l Coaching. Work with a personal wellness coach by phone to manage your weight, quit tobacco, reduce stress, or start exercising. l Fitness tips. Find inspiration, tips, and program ideas at kp.org/fitness. l Healthy lifestyle programs. Manage a specific health issue or condition with a personalized plan. l Healthy living classes. Learn new strategies for familiar challenges. l Healthy discounts. Save on fitness club memberships, acupuncture and chiropractic, and more. l Online tools. Take advantage of health calculators, assessments, and educational resources at kp.org. l Use the My Health Manager app. You can schedule appointments, refill prescriptions, and more all from the app. l Call a nurse. If you have a health question, call a Kaiser nurse at 888-KPONCALL (888-576-6225). You’ll find much more information at kp.org. Employee Assistance Program (EAP) Whether it’s balancing work and family, dealing with legal or financial issues, or coping with a major event in your life, we all face challenges from time to time. To help you overcome them, the Employee Assistance Program (EAP) ComPsych through Prudential offers free, confidential counseling and referrals to specialized resources in your community. You or a covered dependent can take advantage of: l Phone consultations 24/7 l Work/life resources and referrals l Up to three face-to-face sessions per issue per year l Webcasts, seminars, and information To get help, just call 800-311-4327 or visit guidanceresources.com. 6

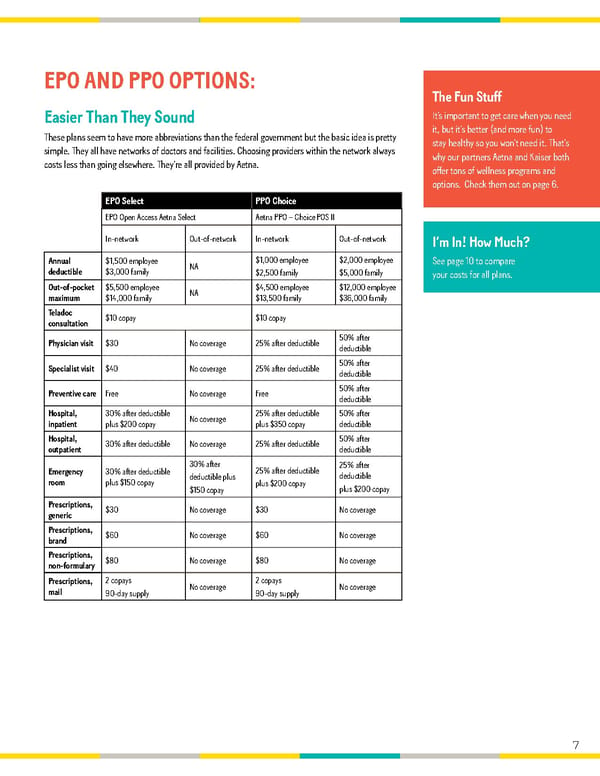

EPO AND PPO OPTIONS: The Fun Stuff Easier Than They Sound It’s important to get care when you need These plans seem to have more abbreviations than the federal government but the basic idea is pretty it, but it’s better (and more fun) to simple. They all have networks of doctors and facilities. Choosing providers within the network always stay healthy so you won’t need it. That’s costs less than going elsewhere. They’re all provided by Aetna. why our partners Aetna and Kaiser both offer tons of wellness programs and options. Check them out on page 6. EPO Select PPO Choice EPO Open Access Aetna Select Aetna PPO – Choice POS II In-network Out-of-network In-network Out-of-network I’m In! How Much? Annual $1,500 employee NA $1,000 employee $2,000 employee See page 10 to compare deductible $3,000 family $2,500 family $5,000 family your costs for all plans. Out-of-pocket $5,500 employee NA $4,500 employee $12,000 employee maximum $14,000 family $13,500 family $36,000 family Teladoc $10 copay $10 copay consultation Physician visit $30 No coverage 25% after deductible 50% after deductible Specialist visit $40 No coverage 25% after deductible 50% after deductible Preventive care Free No coverage Free 50% after deductible Hospital, 30% after deductible No coverage 25% after deductible 50% after inpatient plus $200 copay plus $350 copay deductible Hospital, 30% after deductible No coverage 25% after deductible 50% after outpatient deductible 30% after 25% after deductible 25% after Emergency 30% after deductible deductible plus deductible room plus $150 copay $150 copay plus $200 copay plus $200 copay Prescriptions, $30 No coverage $30 No coverage generic Prescriptions, $60 No coverage $60 No coverage brand Prescriptions, $80 No coverage $80 No coverage non-formulary Prescriptions, 2 copays No coverage 2 copays No coverage mail 90-day supply 90-day supply 7 7

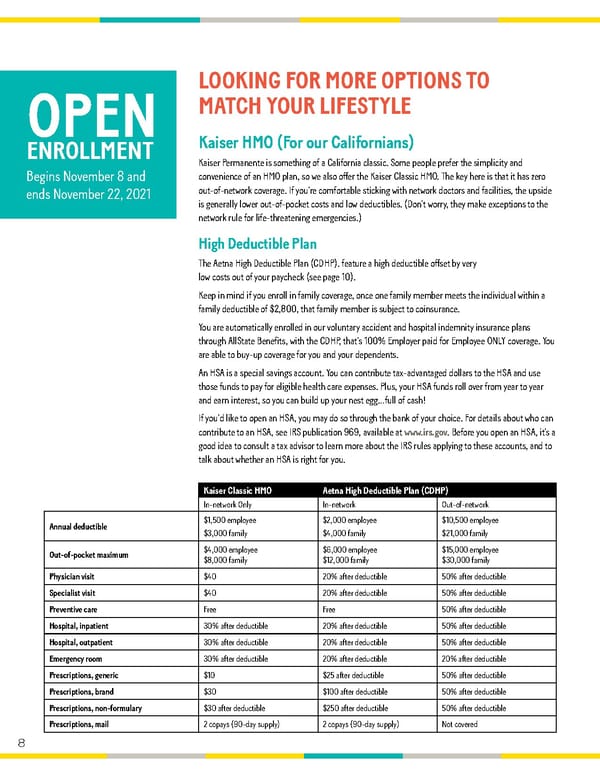

LOOKING FOR MORE OPTIONS TO OPEN MATCH YOUR LIFESTYLE ENROLLMENT Kaiser HMO (For our Californians) Kaiser Permanente is something of a California classic. Some people prefer the simplicity and Begins November 8 and convenience of an HMO plan, so we also offer the Kaiser Classic HMO. The key here is that it has zero ends November 22, 2021 out-of-network coverage. If you’re comfortable sticking with network doctors and facilities, the upside is generally lower out-of-pocket costs and low deductibles. (Don’t worry, they make exceptions to the network rule for life-threatening emergencies.) High Deductible Plan The Aetna High Deductible Plan (CDHP). feature a high deductible offset by very low costs out of your paycheck (see page 10). Keep in mind if you enroll in family coverage, once one family member meets the individual within a family deductible of $2,800, that family member is subject to coinsurance. You are automatically enrolled in our voluntary accident and hospital indemnity insurance plans through AllState Benefits, with the CDHP, that’s 100% Employer paid for Employee ONLY coverage. You are able to buy-up coverage for you and your dependents. An HSA is a special savings account. You can contribute tax-advantaged dollars to the HSA and use those funds to pay for eligible health care expenses. Plus, your HSA funds roll over from year to year and earn interest, so you can build up your nest egg…full of cash! If you’d like to open an HSA, you may do so through the bank of your choice. For details about who can contribute to an HSA, see IRS publication 969, available at www.irs.gov. Before you open an HSA, it’s a good idea to consult a tax advisor to learn more about the IRS rules applying to these accounts, and to talk about whether an HSA is right for you. Kaiser Classic HMO Aetna High Deductible Plan (CDHP) In-network Only In-network Out-of-network Annual deductible $1,500 employee $2,000 employee $10,500 employee $3,000 family $4,000 family $21,000 family Out-of-pocket maximum $4,000 employee $6,000 employee $15,000 employee $8,000 family $12,000 family $30,000 family Physician visit $40 20% after deductible 50% after deductible Specialist visit $40 20% after deductible 50% after deductible Preventive care Free Free 50% after deductible Hospital, inpatient 30% after deductible 20% after deductible 50% after deductible Hospital, outpatient 30% after deductible 20% after deductible 50% after deductible Emergency room 30% after deductible 20% after deductible 20% after deductible Prescriptions, generic $10 $25 after deductible 50% after deductible Prescriptions, brand $30 $100 after deductible 50% after deductible Prescriptions, non-formulary $30 after deductible $250 after deductible 50% after deductible Prescriptions, mail 2 copays (90-day supply) 2 copays (90-day supply) Not covered 8 8

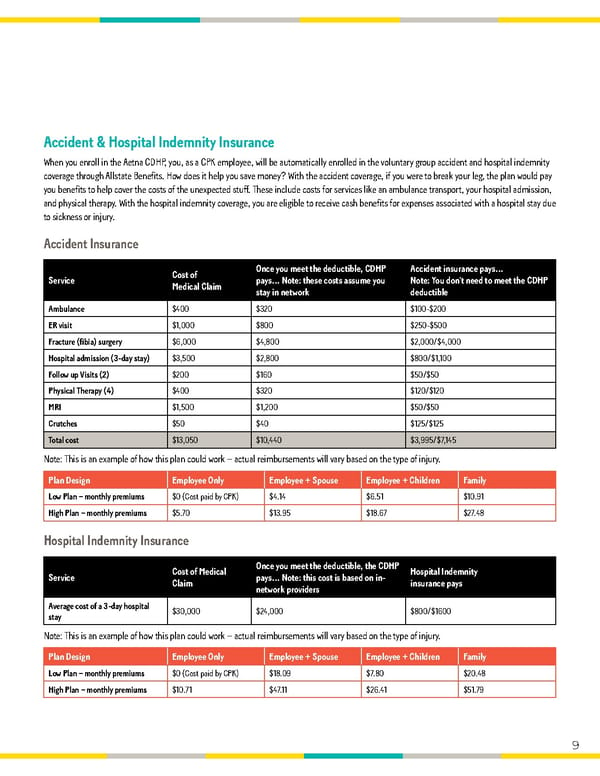

Accident & Hospital Indemnity Insurance When you enroll in the Aetna CDHP, you, as a CPK employee, will be automatically enrolled in the voluntary group accident and hospital indemnity coverage through Allstate Benefits. How does it help you save money? With the accident coverage, if you were to break your leg, the plan would pay you benefits to help cover the costs of the unexpected stuff. These include costs for services like an ambulance transport, your hospital admission, and physical therapy. With the hospital indemnity coverage, you are eligible to receive cash benefits for expenses associated with a hospital stay due to sickness or injury. Accident Insurance Cost of Once you meet the deductible, CDHP Accident insurance pays… Service Medical Claim pays… Note: these costs assume you Note: You don’t need to meet the CDHP stay in network deductible Ambulance $400 $320 $100-$200 ER visit $1,000 $800 $250-$500 Fracture (fibia) surgery $6,000 $4,800 $2,000/$4,000 Hospital admission (3-day stay) $3,500 $2,800 $800/$1,100 Follow up Visits (2) $200 $160 $50/$50 Physical Therapy (4) $400 $320 $120/$120 MRI $1,500 $1,200 $50/$50 Crutches $50 $40 $125/$125 Total cost $13,050 $10,440 $3,995/$7,145 Note: This is an example of how this plan could work – actual reimbursements will vary based on the type of injury. Plan Design Employee Only Employee + Spouse Employee + Children Family Low Plan – monthly premiums $0 (Cost paid by CPK) $4.14 $6.51 $10.91 High Plan – monthly premiums $5.70 $13.95 $18.67 $27.48 Hospital Indemnity Insurance Cost of Medical Once you meet the deductible, the CDHP Hospital Indemnity Service Claim pays… Note: this cost is based on in- insurance pays network providers Average cost of a 3-day hospital $30,000 $24,000 $800/$1600 stay Note: This is an example of how this plan could work – actual reimbursements will vary based on the type of injury. Plan Design Employee Only Employee + Spouse Employee + Children Family Low Plan – monthly premiums $0 (Cost paid by CPK) $18.09 $7.80 $20.48 High Plan – monthly premiums $10.71 $47.11 $26.41 $51.79 9

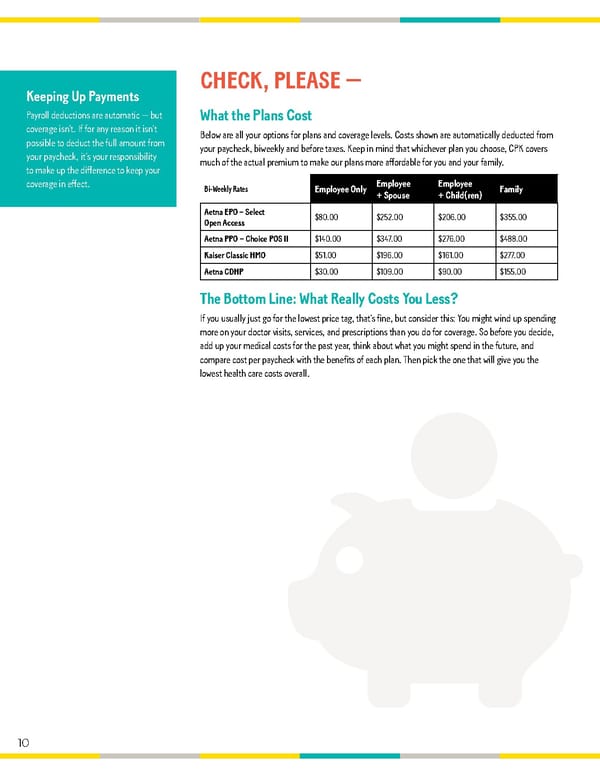

CHECK, PLEASE — Keeping Up Payments Payroll deductions are automatic — but What the Plans Cost coverage isn’t. If for any reason it isn’t Below are all your options for plans and coverage levels. Costs shown are automatically deducted from possible to deduct the full amount from your paycheck, biweekly and before taxes. Keep in mind that whichever plan you choose, CPK covers your paycheck, it’s your responsibility much of the actual premium to make our plans more affordable for you and your family. to make up the difference to keep your coverage in effect. Bi-Weekly Rates Employee Only Employee Employee Family + Spouse + Child(ren) Aetna EPO – Select $80.00 $252.00 $206.00 $355.00 Open Access Aetna PPO – Choice POS II $140.00 $347.00 $276.00 $488.00 Kaiser Classic HMO $51.00 $196.00 $161.00 $277.00 Aetna CDHP $30.00 $109.00 $90.00 $155.00 The Bottom Line: What Really Costs You Less? If you usually just go for the lowest price tag, that’s fine, but consider this: You might wind up spending more on your doctor visits, services, and prescriptions than you do for coverage. So before you decide, add up your medical costs for the past year, think about what you might spend in the future, and compare cost per paycheck with the benefits of each plan. Then pick the one that will give you the lowest health care costs overall. 10

SMILE! YOU’RE SAVING ON DENTAL COVERAGE Free Preventive Care Keep in mind that both plans offer Just like our medical plans, we offer a choice of dental plans and coverage options so you can pick regular checkups, cleanings, and even just the right combination. And likewise, one option is a traditional, see-any-provider-but-it-might- X-rays at 100% coverage. cost-you plan (the PPO). The other is an HMO-style plan (the “DMO”). This only pays for in-network services, requires that you choose a primary care dentist, and typically costs less overall. Aetna DMO Aetna PPO Annual deductible None $50 employee $150 family Preventive care (exams, cleaning, X-rays) Free Free, deductible waived General care (non-surgical treatment for extractions, See schedule 20% periodontics, endodontics, fillings, anesthetics, etc.) for copay Major care (crowns, inlays, gold fillings, fixed bridgework) See schedule for copay 50% Annual maximum None $2,000 (including orthodontia) Orthodontia (adults and children) See Schedule for benefits 50% up to $2,000 lifetime maximum The details can get complicated, but if you’re into that you’ll find them on Calibrate. Better yet, just call Aetna at 877-238-6200. SEE THE BENEFITS: YOUR VISION PLAN You can also choose a comprehensive vision plan from national leader VSP. Benefits are generally higher when you see a provider in their extensive network — which includes Costco Optical. Most services are available once every 12 months, except as shown. VSP Network Out-of-Network Eye Exam $10 copay $73 allowance Lens: Standard $25 copay $33 allowance Bifocal $25 copay $49 allowance Trifocal $25 copay $65 allowance Frames (once every 24 months, $25 (up to $150 allowance) $25 (up to $68 allowance) instead of contact lenses) Contact Allowance $25 (up to $150 allowance) $25 (up to $135 allowance) Your Cost For Coverage Bi-Weekly Rates Employee Only Employee + Spouse Employee + Child(ren) Family Aetna DMO $3.00 $6.00 $6.00 $15.00 Aetna PPO $8.00 $21.00 $17.00 $38.00 VSP Vision Plan $1.00 $2.00 $2.00 $4.00 11

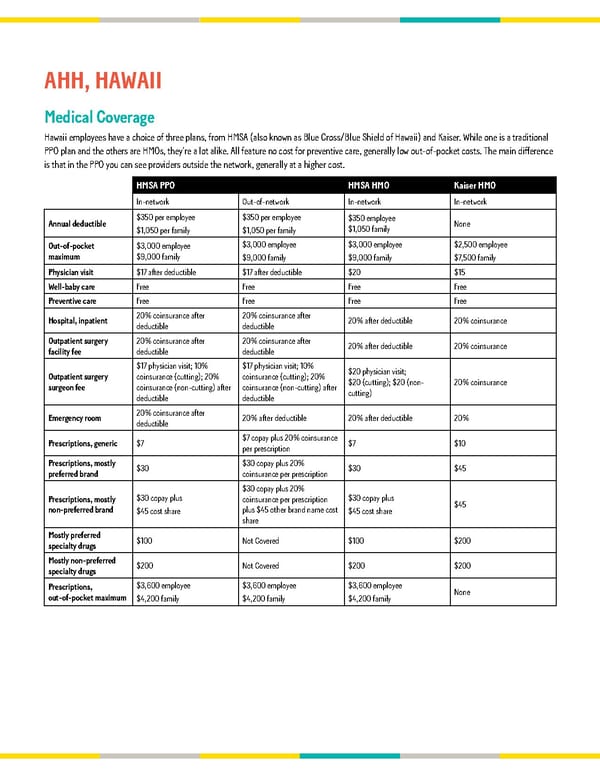

AHH, HAWAII Medical Coverage Hawaii employees have a choice of three plans, from HMSA (also known as Blue Cross/Blue Shield of Hawaii) and Kaiser. While one is a traditional PPO plan and the others are HMOs, they’re a lot alike. All feature no cost for preventive care, generally low out-of-pocket costs. The main difference is that in the PPO you can see providers outside the network, generally at a higher cost. HMSA PPO HMSA HMO Kaiser HMO In-network Out-of-network In-network In-network Annual deductible $350 per employee $350 per employee $350 employee None $1,050 per family $1,050 per family $1,050 family Out-of-pocket $3,000 employee $3,000 employee $3,000 employee $2,500 employee maximum $9,000 family $9,000 family $9,000 family $7,500 family Physician visit $17 after deductible $17 after deductible $20 $15 Well-baby care Free Free Free Free Preventive care Free Free Free Free Hospital, inpatient 20% coinsurance after 20% coinsurance after 20% after deductible 20% coinsurance deductible deductible Outpatient surgery 20% coinsurance after 20% coinsurance after 20% after deductible 20% coinsurance facility fee deductible deductible $17 physician visit; 10% $17 physician visit; 10% $20 physician visit; Outpatient surgery coinsurance (cutting); 20% coinsurance (cutting); 20% $20 (cutting); $20 (non- 20% coinsurance surgeon fee coinsurance (non-cutting) after coinsurance (non-cutting) after cutting) deductible deductible Emergency room 20% coinsurance after 20% after deductible 20% after deductible 20% deductible Prescriptions, generic $7 $7 copay plus 20% coinsurance $7 $10 per prescription Prescriptions, mostly $30 $30 copay plus 20% $30 $45 preferred brand coinsurance per prescription $30 copay plus 20% Prescriptions, mostly $30 copay plus coinsurance per prescription $30 copay plus $45 non-preferred brand $45 cost share plus $45 other brand name cost $45 cost share share Mostly preferred $100 Not Covered $100 $200 specialty drugs Mostly non-preferred $200 Not Covered $200 $200 specialty drugs Prescriptions, $3,600 employee $3,600 employee $3,600 employee None out-of-pocket maximum $4,200 family $4,200 family $4,200 family

Dental and Vision Coverage Just like on the mainland, you can choose from an HMO-like plan that only covers care from network dentists, a traditional plan, or none at all. Both options are provided by HMSA. And to keep you seeing clearly, we offer a comprehensive vision plan from national leader, VSP (see below for plan details). HFDC Network PPO Network Choice of Dentist Any network provider Any dentist Preventive care Free Free Routine Care Varies by service 20% Major care Varies by service 20% Endosteal Implants Not a Covered Service 20% Plan pays up to a maximum of $1,000 paid 25% Orthodontics Special Member Rates Apply initially, remaining 75% paid in equal monthly payments over the term of the Treatment Plan, not to exceed thirty-six months Calendar year Rollover N/A Accumulate up to $1,500** Annual maximum None $2,000 per person **Rollover Amount is up to $600 per year if at least one dental service is received and benefits paid in the prior calendar year do not exceed $800. VSP Network Out-of-Network Eye Exam $10 copay $73 allowance Lens: Standard $25 copay $33 allowance Bifocal $25 copay $49 allowance Trifocal $25 copay $65 allowance Frames (once every 24 months, $25 (up to $150 allowance) $25 (up to $68 allowance) instead of contact lenses) Contact Allowance $25 (up to $150 allowance) $25 (up to $135 allowance) Your Bi-Weekly Cost for Coverage Employee Only Employee + Spouse Employee + Child(ren) Family HMSA HMO $49.00 $295.00 $245.00 $412.00 HMSA PPO $54.00 $330.00 $279.00 $466.00 Kaiser HMO $6.00 $208.00 $173.00 $288.00 HDFC Network Dental $3.00 $20.00 $13.00 $25.00 PPO Network Dental $3.00 $20.00 $13.00 $25.00 VSP Vision Plan $1.00 $2.00 $2.00 $4.00 13

WHEN TO CALL? Call Teladoc When: Picture this: it’s midnight. On Saturday. You’re pretty sure your kid has an ear infection. Wouldn’t it be l You can’t see your regular primary great just to call a doctor and get the prescription emailed to your pharmacy instead of spending half care physician due to timing or travel the night sitting in urgent care? l You need medical attention that you Aetna Teladoc think won’t require a doctor visit CPK employees and dependents who are enrolled in one of our Aetna plans now have 24/7 access l You need to refill a regular to a network of board-certified physicians through Teladoc. The doctors can diagnose many medical prescription and don’t have time for conditions, recommend treatment, and even prescribe medications. an appointment They’re available anytime, any where — all over the phone or through online video. l You want advice or a second opinion about a medical matter The cost for services is just a $10 copay ($40 copay if you’re enrolled in the CDHP until you meet the deductible), and you can pay with a credit card. To set up your account, visit Teladoc.com/Aetna and follow the instructions. To ensure that Teladoc knows you and is ready to help when you need it, don’t skip the medical history section! Then call 855-Teladoc (855-835-2362), or visit member.teladoc. com/cpk. Kaiser Telehealth CPK employees and dependents who are enrolled in our Kaiser CA plan also have 24/7 access to a network of board-certified physicians through Telehealth. You don’t have to visit a facility to get care from the Kaiser Permanente team you know and trust. Here’s how you can get the care you need: l By phone: schedule a phone appointment or call an advice nurse for on-demand guidance. To schedule a phone appointment, call your local appointments and advice number found at kp.org l By email: connect with your care team anytime. Most members receive a reply within 48 hours - often sooner. Visit kp.org for location-specific information and appointments. l By video: schedule an appointment with your doctor, meet with a specialist, or have an on-demand video visit with an on-call physician. Visit kp.org for location-specific information and appointments. 14

PEACE OF MIND, PENNIES FOR A DAY It’s not always fun and games and wellness tips in the benefits world. We think about all the possibilities. So Evidence of Insurability in case something should happen to you, we also offer insurance programs for your family and your peace We trust you, but insurance companies, of mind. not so much. So for STD and some levels Company-Paid Insurance of life insurance you’ll need to give Evidence of Insurability, which basically We start off with life, accident, and disability insurance, all paid for by the company. You’re welcome. means proof of reasonably good health. l Life and AD&D. All Salaried employees are automatically enrolled in company-paid life insurance coverage plus Accidental Death & Dismemberment coverage (sorry, we didn’t make up the name) — both up to one times your annual base salary. l Long-term disability. CPK also provides long-term disability coverage (LTD) in case you’re disabled by an illness or off-the-job injury. The plan pays up to 60% of your monthly income up to a maximum of $10,000 per month, beginning on the 90th day of disability. More Life Insurance If you’re the worrying kind and your company-paid coverage isn’t enough, you can also add life insurance for: l Yourself. Purchase from one to seven times your annual base salary, up to a maximum of $2,000,000. l Your spouse. Get additional family coverage in $5,000 increments up to a maximum of $250,000 for your spouse or partner (but it can’t be more than 50% of your own coverage). l A child. Purchase $10,000 worth of coverage for a dependent child. Short-Term Disability How would you pay your bills if a serious illness or injury kept you away from your job? LTD kicks in after 90 days, but until then short-term disability (STD) insurance can replace your income if you become disabled and can’t work for more than seven days. It pays 55% of your weekly base salary up to a maximum of $1,011 per week. Please note that our plan coordinates with state-mandated plans in Hawaii, New Jersey, and New York. And if you work in California you aren’t eligible – because you’re automatically enrolled in the state- mandated plan instead. Thanks for that, California. 15

NEW! VOLUNTARY PLANS We are pleased to announce that we have added pet insurance and identity theft coverage for 2022. All OPEN employees, regardless of health insurance eligibility, are eligible to enroll in both of the plan offerings below. Brochures for both plans can be found on our Virtual Benefits Fair at http://virtualfairhub. ENROLLMENT com/cpkbenefits. Enrollment is completed directly on the vendor’s website. Begins November 8 and Pet Insurance — Pet’s Best ends November 22, 2021 Pet health insurance provides coverage for veterinary services related to your pet being hurt or sick. Pet’s Best also provides coverage for routine/preventative care, however, does not cover pre-existing conditions. Coverage can be used at any vet in the U.S., including specialists and emergency clinics. Employees can enroll in this benefit at any time. Head to petsbest.com/cpkpets or call 888-984-8700 to enroll today!! Identity Theft — Norton LifeLock Identity theft is on the rise and it’s now more important than ever to have protection. Help protect your identity, as well as your family’s identity, and devices with Norton LifeLock benefit plans. Head to http://cpkft.excelsiorenroll.com to enroll! 16

YOUR FUTURE IS CALLING YOUR FINANCIAL We love what we do, but we know we won’t be doing it forever. So besides benefits for the here and WELLBEING now, we have a program to help prepare for the future as well. Your 401(k) The CPK Retirement Savings Program lets you contribute a part of each paycheck to your personal retirement account. It’s a great way to save for lots of reasons: l It’s pre-tax. This feature helps you save two ways. First, you don’t pay income or payroll taxes on the money you contribute to the plan, so you keep more of your pay. Second, you won’t pay taxes until you take the money out in retirement, so it can grow tax-free to build savings faster. l It’s flexible. You can choose from a range of well-known mutual funds to suit your investment needs, and you don’t have to wait for Open Enrollment to make changes. Unlike the rest of your benefits, enrollment for 401(k) is quarterly, so watch for more info at work. 401(k) enrollment is a little different from the rest of your benefits. You can enroll or make changes every quarter, as long as you’re at least 21 years old and have worked for six months. Retirement Planning Tips Here’s a little retirement-planning wisdom: l Start early. Saving a little right now can actually give you more money in retirement than saving more later on. l Save as much as you can. This is a hard one, but it’s really important. Save even if it hurts. Very few retired people ever look back on their lives and wish they’d saved less. l Don’t stress. You know those people in commercials who trade stocks on their iPads all day? That’s where they belong: in commercials. Here in the real world it’s a good idea to check in on your account occasionally, but otherwise leave it alone and let your money do the work. LOWER YOUR TAXES, BOOST YOUR SECURITY Saving is good. Saving directly from your pay is even better — because when the money is taken out before payroll and income taxes your dollars go farther. Flexible Spending Accounts Most of us have everyday expenses like medical and dental co-payments, deductibles, prescriptions, or child care when we’re at work. So why not save on them by using pretax dollars through a flexible spending account (FSA)? l Health Care FSA. Save on hundreds of health care needs, such as eyeglasses, deductibles, co-payments, prescriptions, dental care, and even over-the-counter medications (when accompanied by a physician’s prescription). You can contribute up to $2,750 per year to a Health Care FSA. Remember if you enroll in a Health Savings Account (HSA), you can’t contribute to a Health Care FSA. Sorry dude, the IRS makes the rules! l Dependent Day Care covers a wide range of care (day care, camps in lieu of child care, elder care, etc.) for IRS eligible members of your family, including children and older adults. You can contribute up to $5,000 per year per household to a Dependent Care FSA. 17

LIFE BEYOND NO MATTER WHERE YOU GO, WORK THERE WE ARE When you’re not creating amazing dining experiences for our guests, we assume you’ll be out there seeking new and bold flavors, going on epic adventures and making your own amazing memories. We’re all about that — so we offer benefits for your life outside of “our four walls” too. Credit union membership. Join Unify Credit Union for: l Low loan rates for auto, home, vehicle, and other major purchases l High interest rates and low minimums on a wide range of checking, savings, and investment accounts l Easy access online, at branches in eight states, or in service centers across the country Wellness programs. In case you missed them, go back to page 6 for a huge range of programs to keep you healthy. KINDNESS Fund. The KINDNESS Fund helps employees facing sudden financial emergencies due to crises in their lives through the generous contributions of our people. It’s a commitment from one employee to the next, that in the best of times and the worst of times, we have each other’s backs. To give or receive a little kindness, ask your manager, check out Calibrate, or contact [email protected] for more information. NEXT STEPS Ready to Enroll? l Visit calibrate.cpk.com. l Log on using your Employee ID Number and Password Note: If you’ve forgotten your Calibrate log-in info, click on the “password reset” button. You can Procrastinators Take Note! reset your own password a number of ways like: answering the security questions you set-up, If you miss Open Enrollment, emailing a new password to you, or if you haven’t logged on for more than 6 months, your password you will not have coverage in 2022 has been reset to the default combination of your birth month, birth date and five digit zipcode of for any benefit plans, even if your home address in the format MMDDZZZZZ Click on Tasks (tab on the left side of the page) and select “View the Benefits Enrollment task.” you’re enrolled today. Plus we’ll l You can also call 877-275-2363. be very sad — we look forward to this all year. Your choices take effect on January 1, 2022. If you just can’t wait, print a few copies of the confirmation page to decorate your kitchen. So don’t forget. Got Questions? We Have Answers. Still on the fence about which medical plan to choose? Confused about enrolling your domestic partner? Just contact the CPK Enrollment Center. l 877-CPK-BENE (877-275-2363) 18

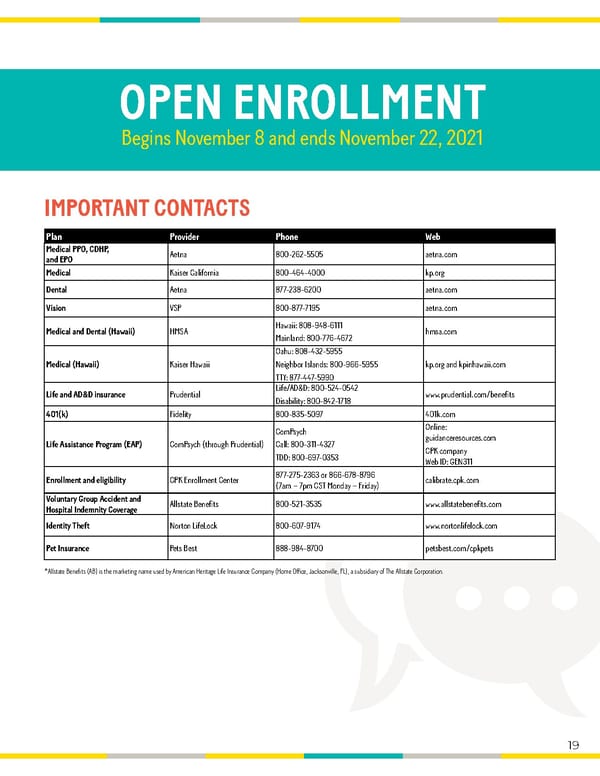

OPEN ENROLLMENT Begins November 8 and ends November 22, 2021 IMPORTANT CONTACTS Plan Provider Phone Web Medical PPO, CDHP, Aetna 800-262-5505 aetna.com and EPO Medical Kaiser California 800-464-4000 kp.org Dental Aetna 877-238-6200 aetna.com Vision VSP 800-877-7195 aetna.com Medical and Dental (Hawaii) HMSA Hawaii: 808-948-6111 hmsa.com Mainland: 800-776-4672 Oahu: 808-432-5955 Medical (Hawaii) Kaiser Hawaii Neighbor Islands: 800-966-5955 kp.org and kpinhawaii.com TTY: 877-447-5990 Life and AD&D insurance Prudential Life/AD&D: 800-524-0542 www.prudential.com/benefits Disability: 800-842-1718 401(k) Fidelity 800-835-5097 401k.com ComPsych Online: Life Assistance Program (EAP) ComPsych (through Prudential) Call: 800-311-4327 guidanceresources.com TDD: 800-697-0353 CPK company Web ID: GEN311 Enrollment and eligibility CPK Enrollment Center 877-275-2363 or 866-678-8796 calibrate.cpk.com (7am – 7pm CST Monday – Friday) Voluntary Group Accident and Allstate Benefits 800-521-3535 www.allstatebenefits.com Hospital Indemnity Coverage Identity Theft Norton LifeLock 800-607-9174 www.nortonlifelock.com Pet Insurance Pets Best 888-984-8700 petsbest.com/cpkpets *Allstate Benefits (AB) is the marketing name used by American Heritage Life Insurance Company (Home Office, Jacksonville, FL), a subsidiary of The Allstate Corporation. 19

OPEN ENROLLMENT Begins November 8 and ends November 22, 2021 The fine print Things our lawyers made us say. Please don’t hate us. This brochure highlights the main features of the CPK benefits program. It is intended to help you make informed decisions about your benefits. This brochure does not include all plan rules and details. The terms of your benefit plans are governed by legal documents, including insurance contracts. Should there be any inconsistencies between this brochure and the legal plan documents, the plan documents are the final authority. CPK reserves the right to change or discontinue its benefit plans at any time.